How to Send an SMS Invoice to Your Customers

Published: Jan 15, 2024

Staying ahead means embracing innovative solutions, and one such game-changer is SMS invoice.

Gone are the days of traditional invoicing headaches.

Imagine a world where your invoices are not buried in cluttered emails but delivered straight to your customers' fingertips.

Enter SMS, a cutting-edge method that transforms the way businesses manage transactions.

Sending invoices the traditional way often leaves businesses grappling with delayed payments, creating unnecessary hurdles.

But fear not—invoice by text is here to streamline your financial operations.

Invoice Text Messages are Taking over

Inboxes flooded with emails often face the dreaded fate of unread notifications.

Here's where SMS steals the show.

The immediacy of text messaging brings your billing to the forefront, increasing the likelihood of prompt attention and action.

The average person checks their phone a multitude of times throughout the day.

Texting capitalizes on this intimate relationship, positioning your invoices where your customers are most engaged.

It transforms conventional payment processes, ensuring that your requests are not lost in the clutter of email inboxes.

With the high open rates of SMS, our payment request is delivered directly to your customer's fingertips, avoiding the risk of being overlooked like typical spam messages.

The Benefits of Text Message Invoices

1. Faster Payments, Fewer Headaches

Time is money, and invoice texting recognizes the value of both.

The simplicity of sending invoices via text message prompts quicker responses and paid faster.

Say goodbye to the delays that often plague traditional methods and welcome a more fluid financial ecosystem.

With texting, the entire process is streamlined since SMS reduces late payments.

This encourages customers to engage promptly with your requests, ensuring that, unlike with most invoices, your billing doesn't get lost in the shuffle.

Get Started Now

Reach your clients now and claim your 30-day free trial. No credit card required.

2. Remedy for Tardiness

Late payments can be a thorn in any business's side.

Text messaging acts as a strategic remedy, significantly reducing instances of tardiness.

The immediacy of text messages serves as a gentle nudge, reminding people to pay and to take action on pending accounts receivable without the need for intrusive follow-ups.

With the ease of sending invoices via text message, small businesses can facilitate a more efficient process to receive funds promptly.

Provide a direct link to your payment process by including your business phone number in your texts.

3. Aligning with Customer Preferences

Customer preferences have evolved, and text messaging aligns seamlessly with this trend.

By meeting your clients where they already are, you not only enhance convenience but also cater to their communication preferences.

The ability to receive payments this way is a sought-after convenience that can save time while providing a user-friendly feature.

How to Text an Invoice Using Dexatel

Step 1: Navigate to the Right Channel

Log in to your Dexatel account and select the SMS channel from the navigation bar.

Step 2: Create a Campaign

Click on "Create Campaign" to initiate the invoicing process.

Choose a distinctive name for your campaign to ensure easy identification.

Step 3: Craft Your Campaign Message

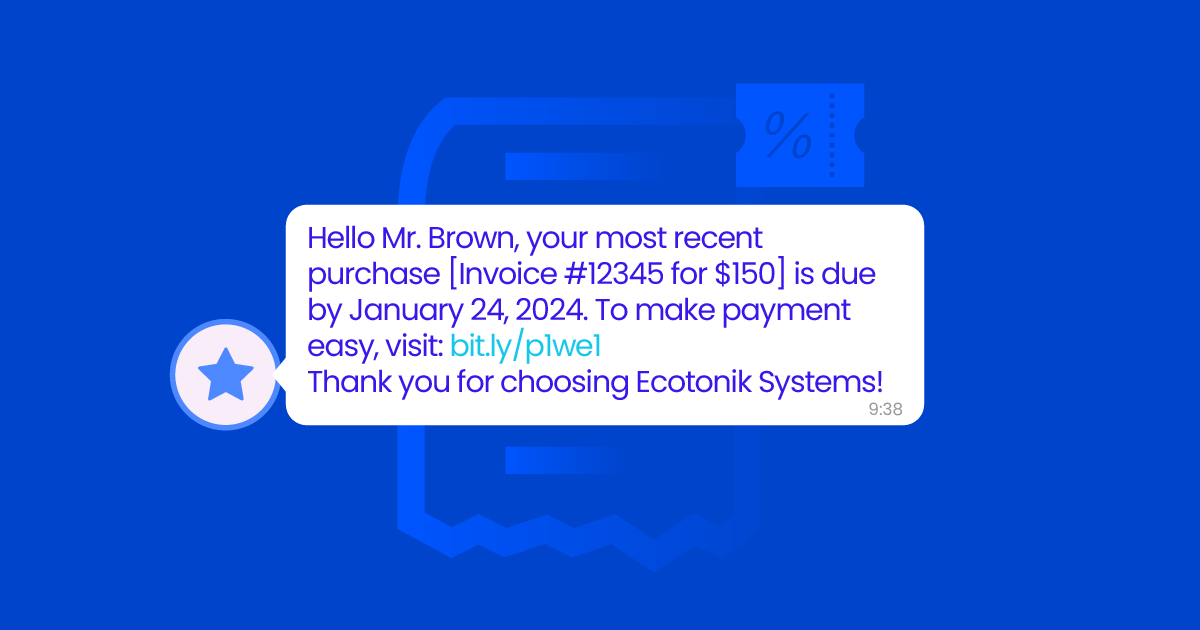

Compose your campaign text message with the necessary details.

Don't forget to include the file link to your invoice; Dexatel makes it easy to attach essential documents.

Step 4: Customize Sender Information

Tailor the sender information according to your preferences.

Whether you choose to display your "Sender Name," "Number," or "Short Code," Dexatel provides the flexibility to align with your brand identity.

Step 5: Select Recipients

Choose the list of recipients for your invoice.

Dexatel's user-friendly interface allows you to seamlessly integrate your contact lists, ensuring precision in targeting.

Step 6: Send Invoices Now or Schedule

Decide whether you want to send texting invoices immediately with "Send Now" or schedule them for a later time.

Best Practices for Sending SMS Invoices

1. Consent is Key

Before you send an invoice, always secure explicit consent from your clients.

Transparency is the cornerstone of trust, and respecting their preferences is a fundamental practice.

Ensure they've opted in to receiving messages from you to maintain a positive and compliant invoicing process.

2. Timely Reminders with a Twist

Send messages strategically by dispatching timely messages with a creative twist.

Incorporate subtle language that motivates prompt payment.

Adding a touch of personality to your reminders fosters a positive relationship with your customer base.

3. Embrace Multimedia Elements

Don't limit your invoices to plain text.

Depending on your industry, consider incorporating multimedia elements to enhance the visual appeal of your SMS invoicing payment requests.

4. Strategic Frequency Management

While regular SMS communication is essential, strike a balance to avoid overwhelming your clients.

Clearly communicate the frequency of your SMS invoices and allow them to adjust their preferences accordingly.

This proactive approach demonstrates your commitment to a respectful and customer-centric invoicing strategy.

Challenges of Sending Invoices and Overcoming Limitations

While SMS invoicing offers numerous benefits, we must acknowledge its limitations and, more importantly, navigate around them for a seamless invoicing experience.

One limitation of certain platforms and services is the lack of built-in support for automatic reminders, which are crucial for maintaining a healthy cash flow.

An effective workaround is to design your personalized reminder sequences outside of the SMS platform.

Leverage your CRM or project management tools to schedule reminders at strategic intervals.

While it requires a bit more manual effort, the personalization and control over the timing can enhance the impact of your reminders.

Explore alternative platforms that seamlessly integrate with your chosen SMS invoicing service.

Finding the right integration can help maintain the efficiency of your invoicing workflow and ensure a smooth transaction process.

While the focus is on SMS, having an email backup system for reminders can act as a safety net.

If your chosen SMS platform lacks automatic reminders, having parallel email reminders can ensure your customers receive payment notifications, fostering consistent communication.

Get Started With SMS Invoicing Today

Dexatel offers a risk-free opportunity to test the waters.

Take advantage of our free trial with no credit card required.

Experience the seamless integration, efficiency, and client satisfaction that invoice text messages can bring to your business.

If you want to get started with SMS invoicing, here's a comprehensive checklist to guide your business through the process:

Ensure compliance with regulations like the Telephone Consumer Protection Act (TCPA)

Secure explicit consent before you send invoices

Research and select a platform that aligns with your business needs

Personalize your messages, incorporating details like date and address without overwhelming the recipient

Respect client preferences by including a straightforward opt-out option

Establish a system for sending reminders, considering the frequency and timing

Implement follow-up sequences to maintain client engagement

Use analytics provided by the platform to refine your approach